Unit 1: Introduction to Macroeconomics

Q. What is Macroeconomics? Explain its importance and limitations.

Q. Distinguish between Micro and Macroeconomics.

Q. What are various variables of Macroeconomics? Explain them briefly.

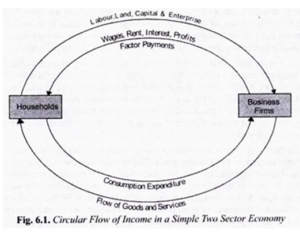

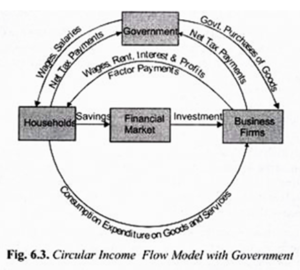

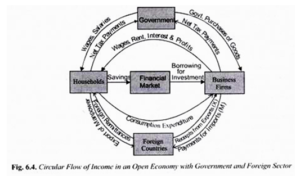

Q. Discuss with diagram the circular flow of income and expenditure in two, three and four sector economy.

Q. Explain various determinants of demand and supply.

Q. What is aggregate expenditure? Write about the components of aggregate expenditure. 2022

Q. Discuss the long-run equilibrium using aggregate demand and aggregate supply.

Q. What is static, dynamic and comparative static analysis in macroeconomics? Explain them briefly. Also distinguish between them. 2022SN

Q. Write short note on leakages and injections.

*******************

Meaning of Macroeconomics

Macroeconomics is the study of aggregates or groups of entire economy like national income, full employment, total investment, aggregate demand, aggregate supply etc. It is concerned with the aggregates and averages of the entire economy, such as national income, national output, total employment, total consumption, general per capital income, price level etc.

According to Shapiro, “Macroeconomics deals with the functioning of the economy as a whole”.

According to Boulding, “Macroeconomics deals not with individual quantities as such, but with aggregates of these quantities, not with individual income but with national income, not with individual output but with national output”.

Objectives of Macroeconomics

a) To determine income level of the economy.

b) To determine employment level of the economy.

c) To maintain high and sustainable economic growth.

d) To maintain satisfactory balance of payment.

e) To stabilize foreign exchange.

Scope of Macroeconomics

a) Theory of income and employment: Macroeconomics explains the causes behind fluctuations in the level of income and employment. It studies the problems of employment and unemployment.

b) Theory of National Income: Macroeconomics studies generation of national income by Income method, expenditure method and product method.

c) General Price level: Macroeconomics studied the inflation and deflation. Problems regarding inflation, excess demand, deflation, deficient demand, inflationary or deflationary gap are studied with the help of macroeconomics variables.

d) Theory of economic growth: Problems relating to economic growth are studies in macroeconomics. It studies fuller utilisation of resources and their growth to achieve the objective of economic growth ultimately.

e) Theory of international trade: Macroeconomics also studies trade among different nations. It studies economic transactions between two or more countries, balance of payment position of the country, determination of exchange rate etc.

f) Theory of Money: Changes in demand and supply of money effect level of employment. Therefore, under macroeconomics functions of money and theories relating to money are studied.

g) Theory of foreign exchange rates: It also studies the determination of foreign exchange rates.

Importance of Macroeconomics

Prof. J.K. Mehta feels that so long as men live in society, the economist cannot afford to neglect the study of macro-economy. The theoretical and the practical importance of macroeconomics would be clear from the following arguments:

1. Functioning of an Economy: Macroeconomic analysis is a paramount importance in getting us an idea of the functioning of an economic system. It is very essential for a proper and accurate knowledge of the behaviour pattern of the aggregative variables, as the description of a large and complex economic system is impossible in terms of numerous individual items.

2. Formulation of Economic Policies: Macroeconomics is a great help in the formulation of economic policies. The days of ‘Iaissez faire’ are over and government intervention in economic matters is an accomplished fact. Governments deals not with individuals but with groups and masses of individuals, thereby establishing the importance of macroeconomic studies.

3. Understanding Microeconomics: The study of macroeconomics is essential for the proper understanding of microeconomics. No microeconomic law could be framed without a prior study of the aggregates; for example, the theory of individual firm could not have been formulated with reference to the behaviour pattern of one single firm, howsoever representative it might have been; the theory was possible only after the behaviour pattern of several firms had been examined and analysed.

4. Understanding and Controlling Economic Fluctuations: Economic fluctuations are a characteristic feature of the capitalist form of society. The theory of economic fluctuations can be understood and built up only with the help of macroeconomics, for here we have to take into consideration aggregate consumption, aggregate saving and investment in the economy. Thus, we are led to analyse the causes of fluctuations in income output and employment, and make attempts to control them or at least to reduce their severity.

5. Inflation and Deflation: Macroeconomic approach is of utmost importance to analyse and understand the effects of inflation and deflation. Different sections of society are affected differently as a result of changes in the value of money. Macroeconomic analysis enables us to take certain steps to counteract the adverse influences of inflation and deflation.

6. Study of National Income: It is the study of macroeconomics which has brought forward the immense importance of the study of national income and social accounts. In micro economy such a study was relegated to the background. It is the study of national income which enables us to know that three-fourth of the world is living in abject poverty. Without a study of national income, as a result of the development in macroeconomics, it was not possible to formulate correct economic policies.

7. Study of Economic Development: As a result of advanced study in macroeconomics, it has become possible to give more attention to the problem of development of underdeveloped countries. Study of macroeconomics has revealed not only the glaring inequalities of wealth within an economy but has also shown the vast differences in the standards of living of the people in various countries necessitating the adoption of important steps to promote their economic welfare.

Limitations of Macro Economics

1. Excessive Generalisation: Despite the immense importance of macroeconomics, there is the danger of excessive generalisation from individual experience to the system as a whole. If an individual withdraws his deposits from the bank, there is no harm in it, but if all the people rushed to withdraw deposits, the bank would perhaps collapse.

2. Excessive Thinking in terms of Aggregates: Again, macroeconomics suffers from excessive thinking in terms of aggregates, as it may not be always possible to get the homogeneous constituents. Prof. Boulding has pointed out that 2 apples + 3 apples = 5 apples is a meaningful aggregate; 2 apples + 3 oranges = 5 fruits may be described as a fairly meaningful aggregate, but 2 apples + 3 sky-scrapers constitute a meaningless aggregate; it is the last aggregate which brings forth the fallacy of excessive macro thinking.

3. Heterogeneous Elements: It may, however, be remembered that macroeconomics deals with such aggregates as consumption, saving, investment and income, all composed of heterogeneous quantities. Money is the only measuring rod. But the value of money itself keeps on changing, rendering economic aggregates immeasurable and incomparable in real terms. As such, the sum or averages of heterogeneous individual quantities lose their significance for accurate economic policy.

4. Difference within Aggregates: Under this approach one is likely to overlook the differences within aggregates. For example, during the first decade of planning in India (from 1951-1961), the national income increased by 42%; this however, doesn’t mean that the income of all the constituents – the wage earners or salaried persons – increased by as much as that of entrepreneurs or businessmen. Hence, it takes no account of difference within aggregates.

Microeconomics and Macroeconomics – Interdependence and difference

Interdependence of Microeconomics and Macroeconomics

Both Microeconomics and Macroeconomics are interdependent. Microeconomics is not always restricted to individual units and also Macroeconomics deals with aggregate at smaller level. The interdependence between the two can be studied in the following ways:

1. Microeconomics Depends on Macroeconomics: Micro-variables depend on behaviour of macro-variables i.e., decisions at micro level depend on decision taken at macro level. For example, Increase in overall tax rate would influence an individual decision to buy a T.V. set as its price goes up.

2. Macroeconomics depends on Microeconomics: Macro-variables depend on micro-economic variables i.e., decisions at macro level depend on decision at micro level. For example, Aggregate demand depends on the demand of individual households of the economy.

Difference between Micro and Macroeconomics:

a) Micro economics studies individual economic units whereas macroeconomics is concerned with economy as a whole.

b) The word micro has been derived from the Greek word micros which means small. On the other hand, macroeconomics is also derived from the Greek word macros which means large.

c) Micro economics was developed by classical and neo-classical economist Adam Smith and Alfred Marshall. Macroeconomics was developed by modern economist J.M. Keynes.

d) Micro economics is known as Price theory because it helps in determination of price on the basis of individual demand and supply. Macroeconomics is known as aggregate theory because it helps in determination of income and employment with help of aggregate demand and supply.

e) Microeconomics is concerned with allocation of resources whereas macroeconomics is concerned with the full utilization of resources.

f) Micro economics is based on partial equilibrium analysis which helps to explain the equilibrium conditions of an individual, a firm, an industry and a factor. On the other hand, macro-economics is based on general equilibrium analysis which is an extensive study of a number of variables working of the economic system as a whole.

g) The objectives of micro economics on demand side is the maximize utility whereas on the supply side is to minimize profits at minimum cost. On the other hand, the main objectives of macro-economics are full employment, price stability, economic growth etc.

Macroeconomic Variables

Macroeconomics studies the behaviour of economic aggregates. Macroeconomic variables are associated with economic aggregates: a country, a region, the population of a country, all companies in a country. For example, the aggregate production of a country is formed with the production of all its businesses, families, individuals, and its public sector. Other commonly used variables in the study of macroeconomics are:

a) Gross Domestic Product

b) Inflation

c) Unemployment

d) Government Spending

e) Interest Rate

f) Exchange Rates

a) Gross Domestic Product: The Gross Domestic Product is the monetary value of final goods and services produced by an economy in a given period of time, usually one year. The Gross Domestic Product is usually used as a measurement of a nation’s economic activity. If the GDP grows, it means that the economy increased its output.

b) Inflation: Inflation is the proportional variation of the Consumer Price Index over a period of time. Inflation is an important macroeconomic variable because it has a close relationship with other variables. For instance, high economic growth with low unemployment imply a risk to high inflation.

High inflation rates are undesirable for an economy, because inflation doesn’t affect all prices equally. High inflation rates produce changes in relative prices and affect economic growth.

A negative (lower than zero) inflation rate is usually not a good sign, especially if unemployment is high. When inflation is negative, it’s called deflation. Deflation combined with unemployment is a dangerous situation because economic agents have incentives to hold domestic currency as a way of savings. In this case, expansionary monetary policy can have little effect to increase the GDP.

c) Unemployment: Unemployment Rate is an important macroeconomic variable because it measures the percentage of the labour force currently unemployed and actively seeking employment. A high unemployment rate is an undesirable macroeconomic situation because it means that a lot of people cannot find a job.

d) Government Spending: Government Spending refers to government consumption, investment and transfer payments. Government Spending provides an indicator of the size of the public sector in an economy. Fiscal policy is used to influence other macroeconomic variables, like unemployment and inflation rate.

e) Interest Rate: The Interest Rate is the cost of borrowing money. The monetary authority (in the US, the FED, in other countries, Central Banks) play a key role in the interest rates, using regulation and intervention in monetary markets.

Interest rates influence macroeconomics through several channels. For instance, a high interest rate can be associated with lower inflation, because people will buy more bonds and bank investments, and this will result in less monetary expansion.

f) Exchange Rates: Exchange Rates play an important role in macroeconomics. All economy sectors that produce goods or services that can be exported or imported are heavily influenced by the exchange rate. There are two types of exchange rates:

– Nominal Exchange Rate: The number of units of the domestic currency that are needed to purchase a unit of a given foreign currency.

– Real Exchange Rate: the ratio of a foreign price level and the domestic price level, multiplied by the nominal exchange rate. It measures the price of foreign goods relative to the price of domestic goods.

The nominal exchange rate influences the flow of capital, the price of financial assets and interest rates in the short term. The real exchange rate influences the competitiveness of different economic sectors of a country.

Circular Flow of Income

In economics, the terms circular flow of income or circular flow refer to a simple economic model which describes the reciprocal circulation of income between different sectors. A continuous flow of production, income and expenditure is known as circular flow of income. It is circular because it has neither any beginning nor an end. The circular flow of income involves two basic assumptions:

1. In any exchange process, the seller or producer receives the same amount what buyer or consumer spends.

2. Goods and services flow in one direction and money payment to get these flow in return direction, causes a circular flow.

Role of government in circular flow of income:

The role of government is important. It acts as regulator and as an agent of promoting public welfare in the country. The relationships between households and the government and between firms and government can be explained in the following way. The government receives taxes from households and firms which are withdrawals or leakages from the circular flow of income. Government also purchases goods and services from households and firms. These government purchases are injections into the circular flow of income. Apart from purchases, government also makes transfer payments. Transfers payments to households are in the form of unemployment allowance, old age pension, scholarship etc. Government also provides subsidies to the firms.

Importance of study of circular flow of income models

The study of circular flow of income is important in the following ways:

a) Circular flow models help us to understand the mutual interdependence among different sectors of the economy namely household sector, producing sector and government sector.

b) They also help in identifying various types of leakages and infections in the economy.

c) Circular flow of income facilitates the estimation of national income. There are three phases in circular flow of income viz. production phase, income phase and expenditure phase.

Two Sector Model:

It signifies that the expenditure of buyers (households) becomes income for sellers (firms). The firms then spend this income on factors of production such as labour, capital and raw materials, “transferring” their income to the factor owners. The factor owners spend this income on goods which leads to a circular flow of income. The circular flow divides the economy into two sectors: one concerned with producing goods and services, and the other with consuming them.

Resources are converted into goods and services by business, and in this transformed state travel back to consumers. Money flows in the opposite direction. These flows involve two markets in which exchange takes place: the resource or factor market in which business buys resources, and the goods and services market in which business sells goods.

Three Sector Model

It includes household sector, producing sector and government sector. It will study a circular flow income in these sectors excluding rest of the world i.e. closed economy income. Here flows from household sector and producing sector to government sector are in the form of taxes. The income received from the government sector flows to producing and household sector in the form of payments for government purchases of goods and services as well as payment of subsides and transfer payments. Every payment has a receipt in response of it by which aggregate expenditure of an economy becomes identical to aggregate income and makes this circular flow and unending. This can be understood with the help of following diagram:

Four Sector Model

A modern monetary economy comprises a network of four sector economy these are-

1. Household sector

2. Firms or Producing sector

3. Government sector

4. Rest of the world sector.

Each of the above sectors receives some payments from the other in lieu of goods and services which makes a regular flow of goods and physical services. Money facilitates such an exchange smoothly. A residual of each market comes in capital market as saving which in turn is invested in firms and government sector. Technically speaking, so long as lending is equal to the borrowing i.e. leakage is equal to injections, the circular flow will continue indefinitely. However, this job is done by financial institutions in the economy.

Leakages and Injections

Leakages: These are those flow variables which have a negative impact on the process of production in the economy. These variables reduce the flow of income in the economy; hence called withdrawals or leakages. These are:

1. Savings

2. Imports

3. Taxes

Injections: These are those flow variables which cause an expansion in the process of production in the economy. These are:

1. Investment

2. Exports

3. Government expenditure

Basically all these are expenditure variables-expenditure on the goods and services produced in the economy. These variables affect the economy in two ways:

a) Add to production capacity of the economy

b) Generate demand for the produced goods and services.

Relationship between Leakages and Injections in Circular Flow:

a) The circular flow will remain at a constant level if saving(S), Tax revenue (T), and imports (M), which are leakages, are equal to investment (I), Government expenditure (G), and exports (X) which are injections in the circular flow of income.

S+T+M=I+G+X

b) If all leakages are equal to injections, the economy will not change.

c) If leakages are greater than injections, than the income level will decline and the economy will contract/fall into a recession.

d) If injections are greater than he leakages, than the income level will rise and the economy will expand into a recovery.

Difference between Leakages and Injections

|

Leakages |

Injections |

|

Leakages refer to the withdrawals from circular flow of income |

Injections refer to the additions to circular flow of income. |

|

They have a negative impact on the process of production (or the process of income generation). |

They have positive impact on the process of production or income generation. |

|

Leakages (a) Reduce flow of income/production. (b) Reduce demand of goods and services. |

Injections (a) Add to the production capacity of the economy. (b) Generate demand of goods and services. |

|

Examples: Saving, taxation and imports. |

Examples: investment, exports, consumption expenditure. |

Methods of Microeconomic Analysis

Three methods/approaches are employed in construction and analysis of economic model in macroeconomics.

a) Static Analysis

b) Dynamic Analysis

c) Comparative Statics Analysis

a) Static Analysis:

The word ‘static’ has been taken from physical science. It points to a position of complete rest.

In other words, by static is meant a position where there is the absence of any movement.

But the concept of statics has its different meaning in economics. It does not point to a position of complete rest or no movement. In economics, the concept of static refers to a situation where there is a movement. But this movement is continuous, certain, regular and constant. Static economics does not deal with the unexpected changes. It studies only the expected economic activities. There are no windfall changes or fluctuations in economic activities. According to Prof. Harrod, “An economy in which rates of output are constant is called static.”

Economic activities are repeated in different time periods in a static economy. No changes in economic activities occur. For example, India’s national income increased by 5% in 1977-78. The increase in 1978-79 and 1979-80 was also 5%.

The study of national income is called a static analysis because the rate of increase in national income is the same. In other words, this study of India’s national income shows that Indian economy passed through a stationary state during these years. According to J R. Hicks, “Economic statics covers that part of economic theory where we do not trouble about dating.”

Scope and Importance of Static Economics:

Static economics occupy an important role in economics. According to Prof. Harrod, “Statics will remain an important part of the whole economics.”

We can explain the importance and scope of static economics as under:

1. It is the simple and easy method of economic analysis. It is easier to understand and economical in thought.

2. It is the basis of the principle of free trade. The principle of free trade which was favoured by classical economists like Adam Smith is an integral part of static economics.

3. Robbins’ definition is also the subject matter of static economics. Robbins defined economics as a science which studies human behaviour as a relationship between ends and scarce means which have alternative uses. This definition is a part of static economics.

4. Static economics gives knowledge of the conditions of equilibrium. It tells that price is determined where demand for the supply of goods is equal. Similarly, income is in equilibrium where planned investment and planned savings are equal.

5. It is the basis of dynamic analysis. Prof. Hicks has pointed out that static economics occupies an important role because it gives a lot of information for the proper understanding of dynamic economics. We can understand the path of equilibrium only after studying the conditions of equilibrium.

6. Keynes’ theory is also static in nature. It shows only a once-over change of variables like consumption function, multiplier, liquidity preference, etc. The effect of once-over change of economic valuables is studied in static economics.

Limitations of Static Economic Analysis:

Static economic analysis has its drawbacks too.

They are given below:

1. Constancy of Variables: Prof. Clark and Stigler have assumed many economic variables as constant. They are population, quantity of capital, natural resources, techniques of production, habits and fashions, etc. We know that these economic factors change in reality. So static economic analysis is far from reality.

2. Unrealistic Assumptions: Static analysis is based on unreal assumptions like perfect competition, perfect mobility, perfect knowledge, full employment, etc. These assumptions are far from the real world. That is why Prof. Hicks said, “Stationary state in the end is nothing but an evasion.”

3. It ignores Time Element: Another shortcoming of the static analysis is that it studies a timeless economy. But in reality, many changes occur with the passage of time. Therefore, it gives a narrow explanation of economic problems.

4. It does not explain the Path of Equilibrium: Static analysis explains only the final state of equilibrium. And comparative statics compares only the two final equilibrium states. It does not show how this new equilibrium has been reached. Though comparative static economic analysis has many drawbacks, yet it occupies an important role in economics.

Many important classical laws are a part of static economic analysis. Moreover, it is a simple type of economic analysis. It is easier to understand.

b) Dynamic analysis:

The concept of dynamics is derived from Physics. It refers to a state where there is a change such as movement.

Tides of the sea, a bird flying in the sky are examples of dynamics. But the word ‘dynamic’ has a different meaning in economics.

We have known that there is movement in statics also but this movement is certain, regular and expected. While dynamics refers to that movement which is uncertain, unexpected and irregular.

Therefore, an aero plane flying in the sky is in a dynamic state only if its direction, height and speed are uncertain. We know from day to day experience that fluctuations occur in the economy quite often. And it is not possible to make correct predictions about such fluctuations.

The concept of dynamics is nearer to reality. In dynamic economics we study the economic variables like consumption function, income and investment in a dynamic state.

In the real world, economic variables like population, capital, techniques of production, fashions, habits, etc. do not change at a constant rate. The rate of change is different at different times.

For example, the population of a country may increase at a rate of 2% in the first year; 3% in the second year and 5% in the third year, if the other economic variables change at unequal rates, the rate of output will also change at different times. In a dynamic state, there is uncertainty of every change. So, it is not possible to make correct predictions.

Recently the concept of dynamics has been applied to the economy as a whole, Prof. Clark has pointed out the following features of a dynamic economy:

1) In a dynamic economy, population grows;

2) Quantity of capital grows;

3) Modes of production improve;

4) Industrial institutions undergo changes. Inefficient organizations are replaced by efficient organisations.

5) Habits of the people, fashions and customs change, as wants of the people increase.

We can conclude by saying that dynamic economics relates to a dynamic economy where uncertainty and expectations play their part.

Scope and Importance of Dynamic Economics:

Dynamic economics is becoming more and more popular since 1925. Though the principles advocated by Clark and Aftalian were dynamic in nature yet their main purpose was to explain the business fluctuations. After 1925, dynamic economics became popular not only in business fluctuations but also in the determination of income and growth models. The following points explain the scope and importance of dynamic economics:

1. Study of Time Element: Time element occupies an important role in dynamic economics. Economic problems concerning continuous change of economic variables and path of change can be studied only in dynamic economics.

2. Trade Cycles: Theories of trade cycles have been advocated only through the introduction of dynamic economics. Theories of trade cycles are based on dynamic economics as they refer to the fluctuations of the different time periods.

3. Basis of many Economic Theories: Dynamic economics has an important place in economics because many economic theories are based on it. For example, saving and investment theory, theory of interest, effect of time element in price determination, etc. are based on dynamic economics.

4. More Flexible Approach: Dynamic analysis is more flexible. Models regarding the possibilities of economic change can be development in dynamic analysis. That is why it has been found a useful mode of study. Dynamic economics is also useful in solving the problems of economic planning, economic growth and trade cycles.

5. Realistic Approach: Dynamic economic analysis is nearer to the reality. In a real world, economic variables like national income, consumption, etc. change irregularly and uncertainly. Moreover, economic variables of the previous period also affect the present economy. And time clement occupies an important role in economic analysis.

Limitations of Dynamic Economics:

Dynamic economic analysis has its shortcomings too. It is difficult to understand. Its main limitations are the following:

1. Complex Approach: Dynamic economic analysis is a complex approach for the study of economic variables because it is based on time element. To find solutions of various problems, we have to make use of mathematics and economics which is beyond the understanding of a common man.

2. Not Fully Developed: Many economists like Samuelson and Harrod, have developed dynamic approach of economic analysis. They have developed their theories through dynamic analysis. But this mode of economic analysis has not been fully developed. The reason is that factors affecting economic variables change very soon. Dynamic approach is not developing at the speed at which economic factors change.

c) Comparative Statics Analysis

As it is clear by its name itself, it is a comparative study of economic conditions at two equilibrium positions at two different points of time. In other words, it refers to the technique of analysis which economists employ for comparing positions of economic variables and their relationship under equilibrium conditions at different points of time.

The economic forces that determine the equilibrium position for a model may be expected to change over time so as to displace the original equilibrium and lead to the establishment of a new equilibrium. So, one can compare the two equilibrium positions and explain the change between the two in terms of the changes in forces. The analysis of this kind of change from one equilibrium to another may be handled by the method of comparative statics.

Importance: It assumes great significance where the object is to predict the future course of an economy on the basis of the past experience. Through method of comparative statics, we can show the direction and magnitude of the change in equilibrium price and quantity that follows from changes in the underlying forces that causes the shifts in the supply and demand curve.

Difference between static and dynamic macroeconomic analysis

1. Time Element: In static economic analysis time element has nothing to do. In static economics, all economic variables refer to the same point of time. Static economy is also called a timeless economy. Static economy, according to Hicks, is one where we do not trouble about dating.

On the contrary, in dynamic economics, time clement occupies an important role. Here all quantities must be dated. Economic variables refer to the different points of time.

2. Process of Change: Another difference between static economics and dynamic economics is that static analysis does not show the path of change. It only tells about the conditions of equilibrium. On the contrary, dynamic economic analysis also shows the path of change. Static economics is called a ‘still picture’ whereas the dynamic economics is called a ‘movie’ of the market.

3. Equilibrium: Static economics studies only a particular point of equilibrium. But dynamic economics also studies the process by which equilibrium is achieved. As a result, there may be equilibrium or may be disequilibrium. Therefore, static analysis is a study of equilibrium only whereas dynamic analysis studies both equilibrium and disequilibrium.

4. Study of Reality: Static analysis is far from reality while dynamic analysis is nearer to reality. Static analysis is based on the unrealistic assumptions of perfect competition, perfect knowledge, etc. Here all the important economic variables like fashions, population, models of production, etc. are assumed to be constant. On the contrary, dynamic analysis takes these economic variables as changeable.

Determinants of Demand and Supply

Concept of Demand

The amount of things that customers desire to purchase and have the purchasing power to acquire at a variety of prices is referred to as demand. Commodity demand will stay stable up to a specific price threshold. Buyers will find the items excessively expensive beyond that point, and demand for them will fall.

Demand is just a consumer’s desire to purchase products and services without hesitation and pay the price for them. In layman’s terms, demand is the quantity of items that buyers are ready and willing to purchase at various prices over a specific time period. Preferences and choices are the fundamentals of demand, and they may be expressed in terms of cost, benefits, profit, and other factors.

Determinants of Demand

There are numerous factors affecting demand for a product. These range from price of the commodity, the cost of other commodities, the customer’s earnings, and his or her likes and preferences. Factors affecting demand are:-

a) Buyer’s Income: The buyer’s purchasing power and the demand for a product are determined by their income. An increase in income leads to increased purchasing power and demand, whereas a fall in income leads to decreased purchasing power and demand. There is also a link between income and commodity quality. Quality items will see an increase in demand as income rises, whereas poorer goods would see a reduction in demand. However, if income declines, there will be less demand for high-quality items and more desire for low-cost ones.

b) Price of related services: In the case of complementary products, an increase in the price of one commodity reduces demand for the complementary product. For example, as the price of bread rises, so will the demand for butter. Similarly, an increase in the price of one item increases demand for a substitute product. For example, an increase in the price of tea will increase the demand for coffee and, as a result, lower the demand for tea.

c) Consumer Expectations: When customers expect a product’s price to decline, they will wait to buy it when it is less expensive. In other words, demand decreases. However, if they predict the price to rise, they will buy more of the goods while it is still inexpensive.

d) Taste: Demand is influenced by changes in customer preferences. Demand for a certain item of apparel, for example, is particularly susceptible to shifting consumer fashion choices. The elasticity of demand relates to how sensitive a good’s demand is to changes in other economic factors such as pricing and consumer income.

Concept of Supply

The amount of a commodity provided in the market is determined not just by the price of the commodity, but also by possibly many other factors, such as the pricing of replacement products, manufacturing technology, and the availability and cost of labour and other production factors. Analyzing supply in fundamental economic analysis is looking at the link between various prices and the amount possibly given by producers at each price, while maintaining all other factors that may impact the price constant.

These price-quantity combinations can be shown on a curve called a supply curve, with price on the vertical axis and quantity on the horizontal axis. A supply curve is often upward-sloping, showing producers’ desire to sell more of the product they produce in a higher-priced market.

Determinants of Demand and Supply

There are many factors affecting Supply. Any change in non-price elements would cause the supply curve to vary, but changes in commodity price may be followed along a constant supply curve. Factors affecting supply are:

a) Price of factors of production: An institution’s supply curve is the curve that represents the least price at which the producer is willing to supply the product. As the price of the factors of production rises, so does the minimal price that the producer is ready to provide. As a result, supply falls and the supply curve moves to the left. Cacao tree seeds, for example, were once used to make chocolate. If cacao seed costs rise, so will the cost of creating chocolate. As a result, supply is reduced.

b) Technology: The mechanism through which resources are employed to make commodities is referred to as technology. When more efficient procedures for producing a product are discovered and applied, production costs decrease. As a result, supply rises and the supply curve changes to the right. Technological advancements assist to minimize manufacturing costs while increasing profit.

c) Price of related products: The pricing of a firm’s goods and replacement goods impact the supply of the relevant product. It means that if the price of another item that a business can manufacture rises, firms will produce more of it and less of what they used to produce. In the manufacturing process, alternative products are items that can be produced using the same resources. When the price of green gramme is relatively high, for example, land used for maize cultivation can be used for green gramme cultivation. The corn supply then drops.

d) Producers Expectations: Changes in producer expectations have an impact on the existing supply of the commodity. It is unclear how pricing expectations will impact current supply because they will differ based on the nature of the commodities. Producers, for example, are increasing their supply in anticipation of higher industrial product prices in the future. Current supply is affected by expectations of a change in any factor impacting future profitability. Import restrictions and company taxation are two examples.

e) Number of Producers in the market: The market’s supply is also affected by the number of providers. When the number of suppliers rises, so does the supply, and when the number of suppliers falls, so does the supply.

f) Government policies: Government policies can be identified as a supply factor. The government’s various laws, taxes, and production subsidies all have an impact on supply. Taxes on commodities, for example, will raise the marginal cost of manufacturing. Production subsidies, on the other hand, will lower marginal costs. As a result, the minimum price at which the items must be delivered is increased or lowered.

***

Aur chapter ka vi notes di jiyey na aur dibrugarh University ka privious year ka question paper solved korkey di jiyeye na sir/ma’am